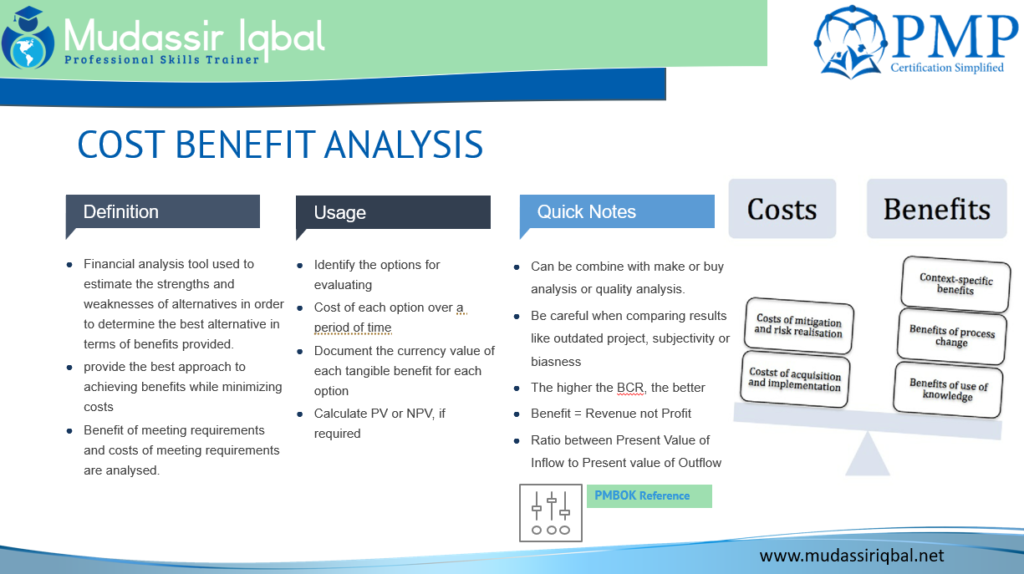

A Cost Benefit Analysis or benefit/cost analysis is a process of determining the pros and cons of any process, product, or activity

or simply

whether the benefits of a project or decision outweigh its costs

Advantages of CBA

Cost-benefit analysis is an effective decision-making tool that relies on data-driven research specific to a problem, considering all types of costs including unpredictable ones. The analysis also requires quantifying non-financial metrics, which can be difficult but forces consideration of aspects that are harder to measure. The ultimate goal is to deliver a simple report that makes decision-making easier for strategic planning.

Limitations of Cost-Benefit Analysis

Cost-benefit analysis is effective for short to intermediate-term projects with small to mid-level capital expenditures. However, for large, long-term projects, it may not account for financial concerns like inflation, interest rates, and varying cash flows. The net present value method helps determine if a project can earn more than the discount rate. Nonetheless, the cost-benefit analysis relies heavily on forecasts, and if one or two are incorrect, it could call the entire analysis into question, thus indicating the limitations of using this method.

Cost–benefit analysis (CBA), sometimes also called benefit–cost analysis, is a systematic approach to estimating the strengths and weaknesses of alternatives. It is used to determine options which provide the best approach to achieving benefits while preserving savings in, for example, transactions, activities, and functional business requirements

The basic steps involved in conducting a CBA include:

- Identify the project or decision: Determine the scope of the analysis and the decision to be evaluated.

- Identify costs: List all the costs associated with the project or decision, including direct costs such as labor and materials, as well as indirect costs such as opportunity costs and environmental impact.

- Identify benefits: List all the benefits associated with the project or decision, including direct benefits such as increased revenue and indirect benefits such as improved quality of life.

- Assign a monetary value to costs and benefits: Estimate the monetary value of each cost and benefit.

- Calculate the net present value (NPV): Use a discount rate to calculate the present value of all costs and benefits.

- Compare costs and benefits: Compare the NPV of costs and benefits to determine if the benefits outweigh the costs.

- Make a decision: Use the results of the CBA to make a decision regarding the project or decision.

CBA is commonly used in public policy and business decision-making processes to assess the economic feasibility of a proposed project or decision. By identifying the costs and benefits of a project or decision, CBA helps decision-makers to make informed decisions that maximize social welfare or shareholder value

Further Readings

What Is Cost-Benefit Analysis, How Is it Used, What Are its Pros and Cons? (investopedia.com).

One thought to “Cost Benefit Analysis”

Pingback: Make-or-Buy Analysis - Mudassir Iqbal